A forecast of the energy transition to 2050

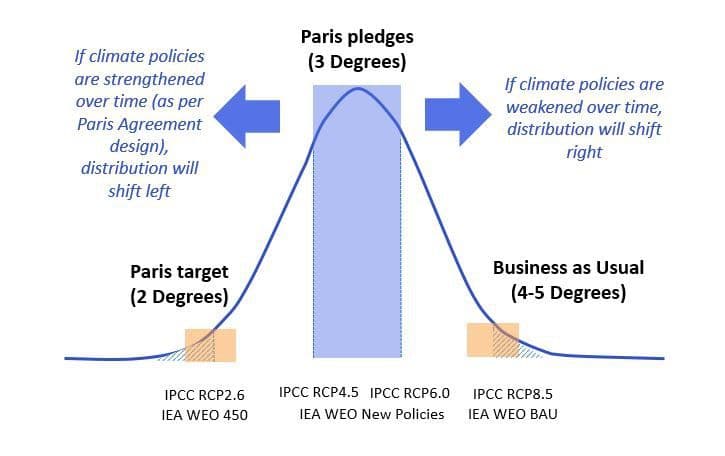

Keeping global warming below 2°C is not likely based on current emission pledges. Investors should consider various scenarios, including scenarios leading to high-end catastrophic changes and low-end scenarios requiring ambitious policies and high transitional risk.

In early September DNV GL launched its Energy Transition Outlook (ETO), a global and regional forecast of the energy transition to 2050.

Do we need another energy outlook?

We have two outlooks from the International Energy Agency, the Energy Technology Perspectives and the World Energy Outlook. Most oil companies produce energy outlooks, including the Statoil Energy Perspectives. The Intergovernmental Panel on Climate Change (IPCC) performs an assessment, every five years or so, on the Mitigation of Climate Change including analysis of emission scenarios. Many more exist.

The DNV GL outlook is a bit different to the others, it is a forecast and not a scenario.

Energy outlooks are generally based onscenarios. Since the future is highly uncertain, scenarios are used to explore the consequences of these future uncertainties. Essentially, scenarios are used to explore how the global energy system may develop under a set of assumed and stylised future worlds.

The DNV GL energy transition outlook is a forecast, a prediction of the future. Essentially, they take a stance on where the world is going.

QUOTE:"Our intention, from the outset, has been to construct what we in DNV GL see as ‘a most likely future’ for energy through to 2050."

QUOTE:"Our intention, from the outset, has been to construct what we in DNV GL see as ‘a most likely future’ for energy through to 2050."

To cut to the chase, the DNV GL energy transition outlook ends with a world that burns enough coal, oil, and gas leading to about 2.5°C at the end of the century.

DNV GL still"strongly supports the Paris Agreement", implying they want the world to be"well below 2°C".

Why would they want to look at an outlook for a 2.5°C world?

In a risk setting, I would argue it is necessary to know where the world is going. The risk (and opportunity) for incumbents is to deviate from the expected path. To use a common example, if the world moves faster towards climate action, then there is a risk of stranded assets and opportunities in renewable energy technologies.

CICERO Climate Finance has used a similar framing. Financial risk associated with climate impacts or rapid societal transitions lies in the tails of the probability distribution, moving away from where current investments lie, thereby exposing financial and physical assets. The opportunities also lie in the tails, investing early before the transition is made.

The use of a single forecast in the DNV GL energy transition outlook does not allow the opportunities and challenges of a more rapid transition (e.g., 2°C), or of a slower transition (e.g., 3°C), to be quantified. That would require additional analysis.

Key points from the DNV GL Energy Transition Outlook

Making a forecast of the future is much harder than doing scenarios. Anyone can justify choices they make with scenarios, they are just to explore uncertainties, but forecasts require thinking things through more carefully.

DNV GL, for example, does not use population projections from the United Nations, but uses an alternative dataset which considers how urbanisation and rising education levels are linked to declining fertility. Their forecasted 2050 population of 9.2 billion people, is 6% lower than the United Nations median forecasts.

DNV GL also sees a slowdown in productivity growth as the world becomes more prosperous, which ultimately leads to slowing economic growth. The economy still grows, just not as fast as some others may assume.

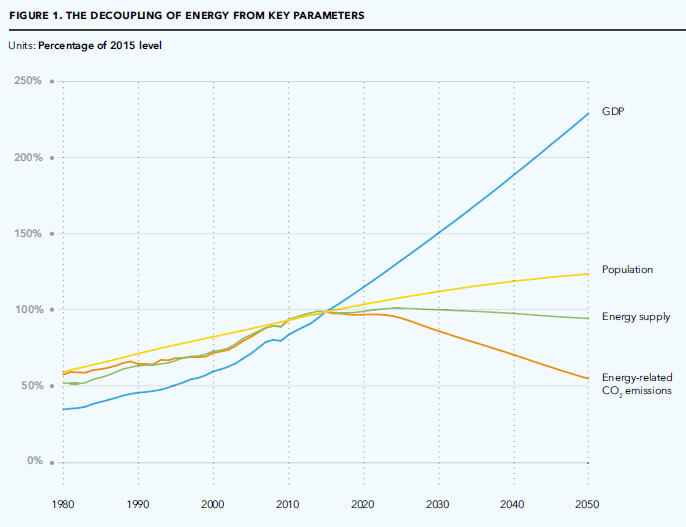

Globally average energy intensity, a measure of how much energy is used per unit economic output, has declined at 1.4% per year in the last 20 years. This relative decoupling is a feature of economic growth and productivity improvements, but DNV GL sees the declines increasing to 2.5% per year to 2050.

The slower population growth, slower economic growth, and stronger declines in energy intensity leads to flattening in energy demand after 2030, and due to a shift to renewable energy sources, a drop in CO2emissions.

While not enough to keep below 2°C, these are still fundamental and unprecedented changes to the global energy system.

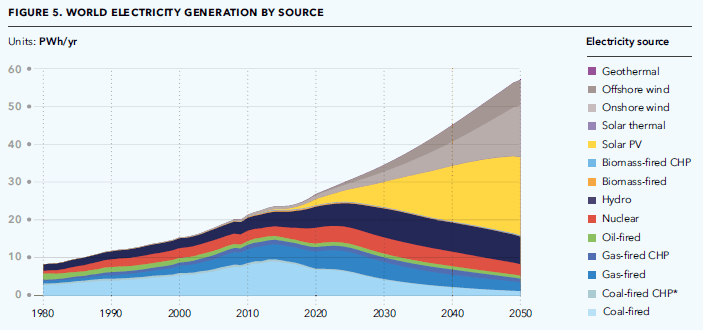

DNV GL sees some rather dramatic shifts in electricity generation, driven primarily by competition on price. Solar and wind both grow rapidly to have a 36% share each of electricity generation in 2050, 72% combined. When adding the contribution from hydro and nuclear, non-fossil energy sources dominate electricity generation in 2050, a significant contrast from today’s dominance of coal and gas.

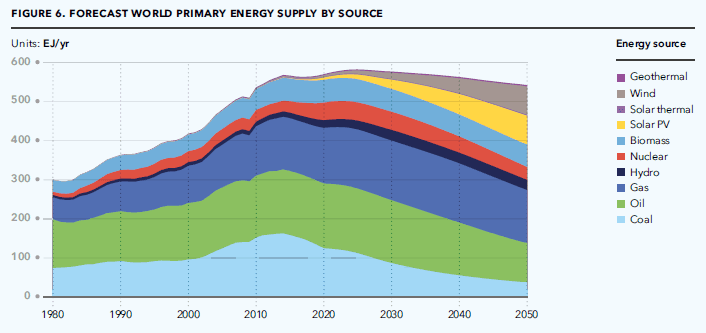

Despite progress on electricity generation, the transition is slower for Total Primary Energy Supply (TPES), where coal (industry) and oil (transport) hang on for longer. Because of the inefficiency of fossil energy sources, they can often look to persist longer in the energy system depending on the accounting system used.

Because of the persistence of oil, and growth in gas, DNV GL sees the need for more investments in oil and gas to satisfy forecast demand. Statoil comes to a similar conclusion in their Energy Perspectives, even when limiting temperature increase to 2°C.

Despite the positive gains in different parts of the energy system, the changes are not sufficient to keep the world below 2°C as pledged in the Paris Agreement. Instead, DNV GL sees the average global temperature to be around 2.5°C above preindustrial levels by the end of the century.

The difference between 2°C and 2.5°C may sound small, but in terms of mitigation it is a big difference. Since DNV GL does not compare against a 2°C consistent scenario, the risks and opportunities of moving to a 2°C pathway are not quantified.

The DNV GL Energy Transition Outlook essentially tells us that we have a long way to go to 2°C, a point on which I agree.