Norway’s elections put oil in the spotlight – now what?

How much more oil and gas will be extracted from Norwegian fields? Here work on the substructure for the Aasta Hansteen platform, July 3 2017 (Photo: Espen Rønnevik og Roar Lindefjeld, Statoil)

Last week, the elections for parliament in Norway raised new questions about the future of oil and gas. Voters in this country, which is by far Europe’s top petroleum producer, re-elected Prime Minister Solberg and other leaders who are determined to expand the country’s oil and gas production. That view – though it won out at the polls – is shared by a declining fraction of the Norwegian public.

The obvious question is: Now what?

Not only about Barents Sea and Lofoten

Much of the public debate focused on making (or keeping) development off limits in the Barents Sea and the Lofoten archipelago, two areas that are also important for fishing and tourism. The debate here will continue, as the political parties remain split on new drilling in these areas.

But for leaders concerned about climate risks, they should also look to the south, to those oil fields in the Norwegian and North seas, where the government’s National Petroleum Directorate has already issued licenses.

Those fields would seem to be a sure bet for development and production, as the companies already have a good sense of what oil is there, and what it will cost to produce. But the fields must still pass standard financial hurdles of risk and return for the owners to press "go" and invest the capital required to build new offshore platforms.

That is where a new debate could emerge, especially given the Solberg government’s signal that it wants to offer further tax cuts to the petroleum industry. Norway’s tax system — long prized for its stability — is already widely believed to be too generous to the petroleum industry. As noted by last year’s Green Competitiveness Committee, current tax breaks may lead to over-investment in oil and gas and, in turn, increased global greenhouse gas emissions.

No-go to investors without tax breaks

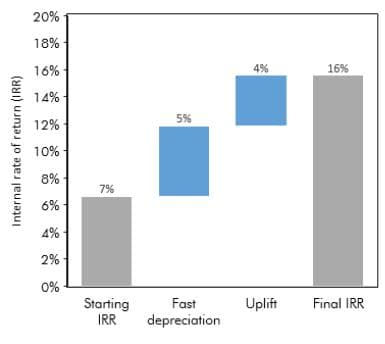

In a new study, just completed, a colleague and I show just how much the tax breaks will boost oil and gas production in the coming years.

We looked at two tax measures, called fast depreciation and uplift, that Norway provides solely to the oil industry. The first allows investors to postpone their tax payments; the second reduces those payments by allowing investors to deduct a portion of their investment twice.