New IEA study highlights remarkable shift in competitiveness of solar PV

Prices of groundmounted solar PV keep falling.

Imagine that you are the obesity patient that for years has been complaining that healthy food is too expensive for your purse. Then unexpectedly comes the consumer agency with a sample of shopping bags, revealing that your perception is wrong: The junk food you are eating is actually more expensive than the healthy food you know should be eating.

The report I refer to is a new IEA study published last week, "Projected Costs of Generating Electricity".

Actually, in this case, the consumer agency itself was partly responsible for your flawed perception.

In its regular publication World Energy Outlook, the message from IEA has until recently been that large-scale solar PV cost 2-3 times more than the conventional alternatives. (For a more detailed discussion of IEAs traditional approach to PV, refererence is made to the report "IEA and Solar PV: Two worlds apart" I wrote for The Norwegian Climate Foundation February 2014, summarized in this article)

This new IEA report is based on data for 181 plants in 22 countries, including 3 non-OECD countries.

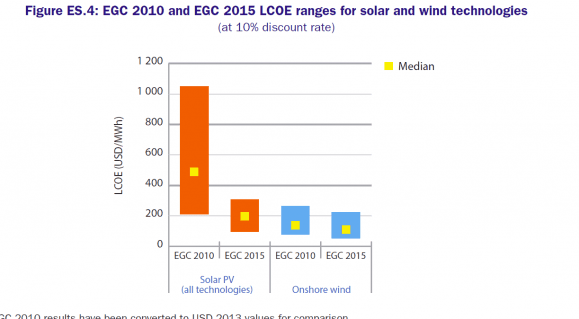

It then applies a coherent set of assumptions to calculate the so-called Levelized Cost of Electricity (LCOE) for each of the main power generation technologies. The most remarkable finding in the report is the dramatically improved competitiveness of solar PV, compared to the established baseload technologies coal, nuclear and natural gas.

Several data in the analysis underpin this finding:

Of course, the data and assumptions used in the report should be treated with caution. Many will argue the data points are too limited, the fuel price assumptions to high or too low, the cost data inaccurate, etc. The model furthermore applies a 30 $/t carbon cost to all technologies. This might look a bit high given today’s carbon prices, but is highly realistic – if not moderate – considering the 30-40 year lifetime of newly built power plants.

The principal comment, however, is that the report – notwithstanding its remarkable finding – still underestimates the cost competitiveness of solar PV. This is partly because it only reflects historic construction costs and does not take into account the projected decline in costs of PV, and partly because it excludes (with the exception of China) all the sunbelt countries where most of the new power generation capacity will be added in the decades to come.

The implications of these findings are indeed far-reaching. I will highlight two of them:

Suddenly, thanks to IEA this time, the prospects for a predominantly renewable electricity-mix look closer and more attractive than ever. This is not least good news for the ministers and negotiators soon heading to Paris to hammer out a realistic and affordable global roadmap towards decarbonization. We do not need new technologies; the solutions for the electricity sector are here, waiting to be rolled-out on a global scale.